Commercial insurance is created to protect businesses. It offers protection against losses caused by injury to the employees, accidents, or other miscellaneous reasons. Some of the commercial insurance that Armourr provides are Fire Insurance, Hull insurance, Engineering Insurance, Liability Insurance, etc. All these insurances create a safety net to protect business owners from unforeseen issues.

It offers cover against fire and allied perils named in the policy. Properties which can be covered under Standard Fire and Special Perils includes industrial and manufacturing risks, dwellings, hotels, offices, shops, utilities and the like

No one has a hold on the powers of mother nature. If your property gets damaged due to an earthquake, cyclone, flood, etc. our insurance will protect you.

With the help of our insurance, you can secure your home against man-made hazards, like riots, terrorism, strikes, and other malicious acts.

It offers protection against the damages to the vessels of boats and other operating equipment, including machinery. We cover

Hull and other machinery business Loss of Hire Indemnity and Protection Charterers Liability Other associated liabilities.

We offer insurance programs for meeting the requirements of the port authorities. Our insurance offers protection to

Damage to cargo while it is under their control or custody.

Third-party liabilities

Professionals Indemnity

Damages to the port properties

Fines and penalties

Business interruptions for unforeseeable reasons.

Human resources are core to an enterprise. Some of the most common insurance offered include Group Mediclaim and Group Personal Accident Group Mediclaim Insurance - It is health insurance that covers a group of people who can be members of a society, employees or professionals of a company. It helps companies identify and mitigate risks faced by employees Group Personal Accident Insurance - Offers compensation to the policy holder in the event of death or disablement due to accidents occurring in any part of the world

Liability insurance covers legal and compensation costs for loss, damage or injury to a third party. It is meant for professionals, business owners, manufacturers, and corporates. It includes product liability insurance, public liability insurance, professional indemnity insurance, director's and officer's liability insurance, cyber-crime liability insurance, commercial general liability etc.

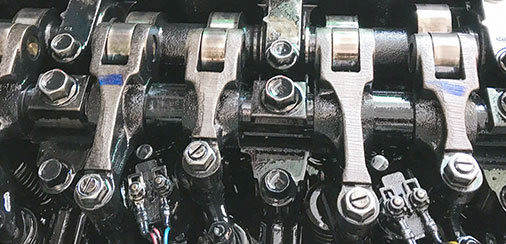

Engineering insurance provides economic safeguard against risks faced by an ongoing construction project, an installation project, and machinery and equipment. Some of the common insurances include Contractor's Plant and Machinery, Electronic Equipment Insurance, Machinery Breakdown Insurance, Boiler and Pressure Plant.

Marine cargo insurance provides full coverage against damage or loss to cargo sent by sea, road, rail, or air

Insurance other than Fire, Marine, liability come under Miscellaneous Insurance. Some of the common insurances include Burglary and Housebreaking Insurance, Money Insurance, and Fidelity Guarantee Insurance.